WHAT WE’RE TRACKING THIS WEEK Good morning and welcome to this week’s briefing. It’s been a relatively slow but diverse week across our sectors of interest, while domestic macro stories took the lead. RATINGS ACTION- #1- Franco-German financial services group Oddo BHF lowered its Carrefour share price target to EUR 15 from EUR 16 ahead of the upcoming release of the retailer’s 3Q 2024 earnings, MarketScreener reports. The share price revision comes amid “difficult” market conditions, including expectations of muted consumption levels on the back of “[fiscal] pressure put by governments on households [and companies],” Oddo said, referring to French taxes. The firm left unchanged its neutral rating on Carrefour’s stock. #2- Goldman Sachs maintained its target price for Amazon shares at USD 230 and reaffirmed its buy rating, TipRanks reports. Goldman sees 24% potential upside over the next year. Across the industry, analysts have given the stock an average target price of USD 224.40, with 45 analysts calling it a “buy” and two giving it a “hold.” Goldman expects Amazon to deliver consolidated revenue growth and expand its margins over the coming years even as it invests in long-term growth initiatives. EARNINGS OUTLOOK- Analysts see Amazon reporting 3Q 2024 earnings of USD 1.14 per share on revenues of USD 157.2 bn, Benzinga reports. Amazon is set to release its earnings this Thursday, 24 October.

#3- UBS, JP Morgan, Barclays maintain ratings on Ahold Delhaize: UBS set a share price target of EUR 27 for Ahold Delhaize and maintained its sell recommendation, MarketScreener reports. The Swiss bank expects the retail chain’s underlying operating profit to reach EUR 821 mn in 3Q, 2024 with a margin of 3.8%. JP Morgan left its recommendation unchanged as “sell”, while Barclays maintained its “hold,” Markets Insider reports. The rationale: Ahold Delhaize has allocated USD 1 bn to invest in the savings proposition and loyalty programs at its US brand, Stop & Shop, through to 2028, the company said previously (pdf). UBS expects the investment plan to ramp up in 2025 (which will be positive for its margins in Europe) but put its margins in the US under pressure, according to MarketScreener.

#3- US-based investment bank TD Cowen maintained its price target for Walmart at USD 85 and reaffirmed its buy recommendation, according to Investing.com. The decision comes as Walmart continues strategic investments in technology and data that contribute to new revenue streams. In August, the firm raised its Walmart price target to USD 85 from USD 80 and reaffirmed its “buy” position. Meanwhile, KeyBanc Capital Markets also raised Walmart’s target price to USD 86 from USD 82, maintaining a recommendation to overweight the stock. The positive outlook is explained by the steady growth in Walmart’s market share in the grocery sector and the company’s e-commerce sales growth. WATCH THIS SPACE- Is Alabbar up to something new in Madagascar? Real estate and retail b’naire Mohamed Alabbar paid a visit to Madagascar last week, where he met with the island country’s president and held several high-level meetings. The visit has sparked speculation of potential planned investments in Madagascar, which could be worth more than USD 1 bn, Arabian Business reports, although it is unclear whether the investment would be through Emaar Properties, Eagle Hills, or another vehicle. SIGN OF THE TIMES- A growing number of analysts and insiders see consumers spending more during this year’s holiday season than they did in 2023. The US National Retail Federation, an industry association, expects consumers to spend 2.5-3.5% more this year than they did in 2023, while Deloitte sees holiday spending growing a more generous 8%. That would make it the slowest pace at which spending has risen in six years. In Canada, PwC sees shoppers spending 13% more on gifts, travel, and entertainment through year’s end while Deloitte sees holiday spending climbing 10%. In the UK, shoppers look set to spend 21% more each in online shopping between Black Friday and Cyber Monday.

|

ECONOMY | UAE UAE economy to grow 3.3% in 2024 -World Bank World Bank cuts UAE growth outlook for 2024: The World Bank has revised downward its growth outlook for the UAE. It’s now forecasting GDP growth of 3.3% for the current calendar year, trimming 0.6 percentage points from its May projection of 3.9%, in its semi-annual MENA economic update — Growth in the Middle East and North Africa (pdf). Its 2025 forecast remains unchanged at 4.1%. The UAE is still expected to lead MENA in real per-capita GDP growth, with the non-oil sector driving a 2.5% increase. Current account surplus to narrow: The report’s authors expect the UAE’s current account surplus to drop to 7.5% of GDP in 2024, down from 9.2% in 2023. Fiscal surplus will hold steady at 4.9% of GDP this year, thanks to expanding non-oil revenues, putting the UAE in line with Qatar as the only countries in the region to maintain a fiscal surplus, thanks to the “expansion of non-oil revenues.” Inflation on the rise: Inflation is expected to reach 2.2% in 2024, driven by rising housing and utility costs, before easing to 2.1% in 2025.

|

ECONOMY | UAE Dubai inflation falls to 2024 low in September Annual inflation in Dubai decelerated to a nine-month low in September, dipping to 2.50% from 3.38% in August, according to figures (pdf) from the Dubai Statistics Center. The lower inflation reading was driven by slower growth of food and beverage, transport, restaurant and accommodation, and insurance and financial services costs. The breakdown: Prices of housing, water, electricity, gas, and other fuels — the largest component of the basket of goods and services — advanced at the highest pace this year to 7.02% in September, compared to 6.92% in August. Meanwhile, food and beverage inflation cooled to 1.81% from 2.75%.

|

IPO WATCH | UAE Lulu Group to sell 25% share in ADX debut Supermarket chain Lulu Group will reportedly take a 25% stake to market in an IPO on the ADX, Zawya reports. The offering is expected to raise USD 1.7-1.8 bn, implying a valuation of USD 6.5-7 bn for Lulu as a whole. The company is expected to announce its intention to float as early as this week and will price the offering “by the end of October,” with trading set to begin in mid-November. Tadawul leg dropped? Last February, unconfirmed reports suggested that Lulu was considering a dual-listing on the Abu Dhabi Exchange and Saudi’s Tadawul. The Tadawul leg is reportedly on hold, but the company remains in discussions for a possible future listing, Zawya quotes the sources as saying. ADVISORS- Emirates NBD Capital, HSBC, Abu Dhabi Commercial Bank, and Citigroup are acting as joint bookrunners for Lulu’s IPO. Moelis & Co. is independent financial advisor on the transaction.

|

TOURISM | UAE Abu Dhabi’s Yas Island and Saadiyat Island report surge in visitors The number of visitors to Abu Dhabi’s Yas Island and Saadiyat Island “surged” over the summer, according to UAE state news agency Wam. Yas Island saw a 72% y-o-y increase in the number of tourists from the GCC visiting the island’s theme parks, while the number of tourists from India visiting the theme parks rose 24% y-o-y during the season. Occupancy rates at the island’s hotels sat at 83%, with August recording a 90% occupancy rate. Hotel occupancy in Saadiyat during the summer rose 13% y-o-y, while the number of hotel guest arrivals rose 19% y-o-y. The island’s total occupancy hit 65% over the summer season, with August recording a 73% occupancy rate.

|

PROPERTIES | UAE One Maryah Place construction begins + Nakheel launches Bay Grove Residences #1- Construction on the One Maryah Place project, a two-tower office complex located on Al Maryah Island, started last week, according to a press release (pdf). Co-developed by Aldar and Mubadala Investment Company and located within the Abu Dhabi Global Market, the project will offer 98k sqm of office space. REMEMBER- Aldar and Mubadala confirmed last month the continuation of their strategic partnership through joint ventures aimed at managing assets across Abu Dhabi valued at over AED 30 bn. The One Maryah Place will be included in Aldar's investment properties, which are currently valued at AED 27 bn in income-generating assets. #2- Aldar Properties also launched Mamsha Palm in Abu Dhabi’s Saadiyat Island in collaboration with Japan’s Koichi Takada Architects, according to Parametric Architecture. Mamsha Palm will include 44 residences and target sustainable building practices. Aldar is aiming to secure a three-pearl Estidama rating and a two-star rating from Fitwel for their sustainable approach. #3- Real estate developer Nakheel launched Bay Grove Residences, a beachfront development on Dubai Islands, featuring four interconnected residential buildings, Arabian Business reports. With an anticipated handover date set for 3Q 2028, the project includes 296 units.

|

PROPERTIES | SAUDI Real estate sales are on the up despite rising prices Real estate sales volumes in Riyadh rose 51.6% y-o-y to 18.5k valued at SAR 26.6 bn in the 12 months to 2Q 2024, according to a report (pdf) by real estate consultancy CBRE. The report indicates that increased migration to the capital city tanks to job creation is likely to sustain price growth in Riyadh over the medium-term. Population growth is expected to further drive market gains. Over in Jeddah + Dammam: Jeddah saw 9.4k transactions over the same period — a 43.2% y-o-y uptick — while sales in Dammam were up 22.4% y-o-y at 2.4k, valued at SAR 2.4 bn. Future growth prospects: Some potential buyers in the market are waiting for “new modern stock, which is expected to bring higher-quality finished units to the market as compared to the existing often aging stock,” while others are holding off on purchases until they find “suitable mortgage provisions to facilitate their home acquisition,” according to CBRE. Riyadh saw higher sales prices: The purchasing price of apartments in Riyadh is currently averaging at around SAR 5k per sqm— a 6.6% y-o-y uptick in the year to 2Q — while that of villas came in at an average of SAR 5.8k per sqm — a 3.3% y-o-y increase as at 2Q. Prices in Riyadh have been rising since the covid-19 pandemic. Apartment prices in Jeddah dipped 0.9% to SAR 3.9k per sqm over the same period, while average villa prices rose 0.8% to SAR 5.7k per sqm.

|

PROPERTIES | SAUDI Cenomi on track to complete flagship Riyadh mall next year Cenomi Centers is set to complete its Jawharat Riyadh mall in 4Q 2025, according to Construction Week. The mall, dubbed “the crown jewel of Cenomi Centers,” will span an area of 185k sqm, featuring a hybrid indoor-outdoor model. The new establishment is expected to generate over 4k jobs, with a contribution upwards of SAR 5 bn to the economy annually. The mall will feature international-standard luxury retail stores (including a number of “first in the Kingdom” outlets) and premium restaurants with immersive digital experiences as well as creative spaces for artists. Cenomi is separately building out Jawharat Jeddah on the country’s Red Sea coast.

|

PROPERTIES | QATAR A handful of agreements for Barwa at Cityscape Qatar 2024 + flat-ish 3Q 2024 earnings Qatar Stock Exchange-listed Barwa Real Estate signed agreements and launched new projects and services at the 2024 edition of Cityscape Qatar, according to a press release (pdf). The event, which wrapped up last week, featured over 60 developers from multiple countries and covered more than 110 projects. #1- Barwa launched the first phase of its Barwa Hills project in Qatar’s Jabal Thuaileb, which includes 57 “exclusive apartments,” according to a press release. The company fully sold out its phase one units by the third day of the exhibition, the Peninsula Qatar reported. Barwa also signed an MoU with Qatar Islamic Bank to provide financing to buyers purchasing residential units in the project. #2- Barwa has begun leasing out the third phase of its Madinat Mawater project, the first district of its kind in Qatar, where people can buy, sell and maintain used cars and vehicles. The company signed key lease agreements for both the maintenance and service centers. The developer also signed agreements with Al Waha for Strong Motors and Jetour, Gulf Times reports. #3- The company launched Madinatna School, which it will develop as part of its Madinatna residential project, according to the statement. Barwa will separately open up bidding for a 20-year lease and operating contract for the school. #4- Barwa inked a long-term concession agreement to provide district cooling services at The Commercial Avenue for a duration of 20 years, according to a separate press release picked up by Zawya. #5- Barwa and its subsidiary, Al Waseef, inked two MoUs with Qatar Stock Exchange-listed Lesha Bank to explore potential investments and to explore whether Barwa and its units could provide maintenance, facility management, and other services to real estate assets managed by Lesha, according to a press release. 9M 2024 earnings up fractionally Barwa, of which the Qatar Investment Authority is the largest shareholder, reported total income of QAE 1.8 bn in 3Q 2024, according to its earnings release (pdf), with EBITDA for the period coming in at QAR 812 mn. It generated c. 79% of its QAR 1.4 bn in operating revenue from rentals. Driving the market: The company says recent changes to freehold ownership rules and a two-tier residency system is pushing foreign residents to buy property, but notes that a supply glut is slowing sales. Oversupply of mall space is also driving down retail rents, it says, while available office stock is growing in supply. The education and healthcare sector should see an uptick in demand, particularly if the government adopts a private-public partnership model for schools. Net income after taxes inched up to QAR 787.7 mn in 9M 2024 from QAR 782.0 mn in the first nine months of last year, according to its financial statements (pdf).

|

RETAIL | UAE DXB gets its first Ray-Ban boutique store Chalhoub Group inaugurated the first Ray-Ban boutique store at Dubai International Airport this month, according to a press release. The store is one of only two worldwide that feature an engraving machine capable of customizing cases and frames.

|

RETAIL | SAUDI Abdullah Al Othaim’s view of the Saudi market Abdullah Al Othaim Markets Company was named by World Business Outlook as Saudi Arabia’s fastest-growing grocery retail chain this year. Al Othaim operates the largest retail store chain in the kingdom serving over 100 cities and governorates through a total of 376 branches, with plans to hit 600 centers before the end of 2026. The sector, by the numbers: The Saudi Arabian food retail market is expected to grow at a compound annual growth rate (CAGR) of 5.67% from 2024-2028, according to separate industry reports cited by World Business Outlook. The online grocery shopping sector is expected to reach 10% of total grocery sales in 2025 and the overall size of the retail market is expected to reach USD 31.4 bn, the publication says. The sector’s growth is expected to be driven by the growing popularity of modern retail formats such as hypermarkets. World Business Outlook is a pay-for-play publication. Given the high likelihood that Al Othaim paid for the story to be written and published, the story is notable for the insight it offers into how the company views its home market.

|

RETAIL | QATAR Nesto, Lulu growing in Qatar #1- Nesto Group will open its first hypermarket in Doha after signing an agreement with The Commercial Avenue, the retailer said in a LinkedIn post. The hypermarket, which spans 180k square feet, is set to open in 2Q 2025. Nesto has plans to invest QAR 2 bn to open 10 hypermarkets in Qatar by 2026, with four of these “already in the pipeline,” the company said, without specifying what stage they are in. #2- Lulu Group opened its 24th outlet in Qatar at the North Plaza Mall, Umm Al Amad last week, bringing the total number of its outlets around the world to 273, according to a press release. The 25k-foot outlet includes an in-house bakery, self-checkout options, wheelchair accessibility, seating areas, and gift wrapping services. Lulu Group plans to open three more stores, with one scheduled to open in 2024 and another two in 1Q 2025.

|

RETAIL | EGYPT Egypt’s Industrial Modernization Center inks cooperation protocol with MAF Carrefour Majid Al Futtaim’s Carrefour will have access to a base of high-quality local suppliers in Egypt offering products at competitive price points, after signing a cooperation protocol with the country’s Industrial Modernization Center (IMF), according to a statement. The protocol aims to meet the retailer’s needs from the local market, ensuring compliance to international standards.

|

LIFESTYLE | SAUDI ARABIA Cenomi Retail opens new Zara store in Azerbaijan Cenomi Retail opened a new Zara store in Baku’s Crescent Mall, according to a disclosure to Tadawul. Crescent Mall has an estimated footfall of 500k people per year, according to the disclosure. The store’s opening will bring the number of stores Cenomi Retail has opened under the Inditex brand umbrella to a total of seven in 2024. Cenomi’s strategy in Azerbaijan: Cenomi is expecting to see its revenues from Azerbaijan growing 20% in 2025 from investments in the country’s retail and tourism sectors. “As consumer demand is increasing, a mix of new store openings and renovations to current stores will be adopted, in addition to new online stores,” the company said.

|

ENTERTAINMENT | UAE Sphere arena opening in Abu Dhabi Sphere is coming to Abu Dhabi: Sphere Entertainment and the Department of Culture and Tourism Abu Dhabi are partnering to build a Sphere arena in the emirate, according to a statement. The venue will match the 20k-seat capacity of the Las Vegas original, with DCT Abu Dhabi overseeing funding and construction. Sphere Entertainment will provide tech expertise, operational support, and creative content, earning annual fees once the arena opens. REFRESHER- New York Knicks and New York Rangers owner James Dolan was reportedly in “serious” discussions with Abu Dhabi investors in December to build here. The move is part of the DCT Abu Dhabi’s broader tourism push: The emirate set aside USD 10 bn in April to nearly double its annual visitors to 39.3 mn and grow non-oil GDP contributions to AED 90 bn by 2030.

|

ENTERTAINMENT | SAUDI ARABIA Muvi, Imax eye production in Saudi + open new screens #1- LA-based DH’BAB productions secured a slate financing and distribution agreement with Saudi studio and cinema chain Muvi, according to Deadline. The agreement will see Muvi use its finance and distribution resources to endorse three projects from DH’BAB. Consultant and executive producer Fadi Ismail, who has a track record of producing Arab content, has acted as a broker on the transaction. No financial details were disclosed on the transaction. #2- Imax is mulling a Saudi film production: Imax is in talks with a Saudi company to produce a local feature film in the next few years, the company’s CEO Richard Gelfond told Arab News. The company in question was not disclosed. BACKGROUND- Imax Corp plans to open more screens across the Kingdom with the aim of reaching 50 screens within five years, according to Arab News. In context: The latest plans include opening four new screens with Muvi, the Kingdom’s largest cinema chain. Imax currently operates 10 cinemas across the Kingdom with plans to open 22 more in partnership with the Kingdom’s top four exhibitors. Since its launch in Saudi in 2019, the country has consistently ranked among Imax’s top 20 markets worldwide and was the company’s fourteenth-largest market in 2024.

|

MOVES | INTERNATIONAL Walmart appoints new chief growth officer Walmart US named Chief Revenue Officer Seth Dallaire as its new chief growth officer, Dallaire said on LinkedIn. Dallaire will lead an expanded division at Walmart that encompasses the product, marketing, and design teams. BIOGRAPHY- In addition to being chief growth officer, Dallaire is executive vice president at Walmart, according to his bio. Prior to joining Walmart in 2021, he served as Instacart’s chief revenue officer, and before that, he held leadership roles at Amazon — including vice president of global advertising sales, where he launched their retail media business.

|

ALSO ON OUR RADAR Amazon rolls out new grocery concept stores + Bim is canceling repurchased shares to reduce capital RETAIL- Amazon trials new Amazon Grocery concept: Amazon launched a new small-format grocery store in Chicago earlier this month, Senior VP of Worldwide Grocery Stores Tony Hoggett said on LinkedIn. The 3.8k square-foot store opened in a space previously occupied by a coffee shop in the Amazon-owned Whole Foods Market, according to Supermarket News. The new store carries 3.5k products, ranging from organic brands to household essentials. It aims to serve Whole Foods shoppers looking to make quick trips for things like grocery top ups, coffee, and grab-and-go meals. AND- Amazon partnered with Khosla-backed grocery fulfillment automation startup Fulfil to test its automated warehouse concept, CNBC reports. The retailer is piloting a new technology in one of its Whole Foods locations in Philadelphia, where a micro-fulfillment center will be attached to the store and allow shoppers to purchase products not typically stocked by the organic grocer, CNBC said. Both Amazon and Fulfil declined to comment. What this means for shoppers: The move will allow customers to purchase items from Amazon’s website and its online grocery service, Amazon Fresh, while browsing Whole Foods. Robots will fetch the items and place them into grocery bags for pick up. CAPITAL MARKETS- Turkey’s Bim United Stores to reduce its capital by canceling repurchased shares: Bim will reduce its issued capital to the equivalent of USD 17.6 mn from USD 17.8 mn by canceling shares it acquired in a buyback, Sanayi reports, a regulatory filing with Borsa Istanbul’s public disclosure platform. MEANWHILE- Bim will distribute a total of TRY 18.2 bn (USD 530 mn) in dividends in 2025 with a a dividend yield of 5.58%, Rota Borsa reports, citing İş Yatırım, the investment banking arm of Türkiye İş Bankası (commonly known as İşbank), Turkey’s largest privately-owned bank. Bim’s company’s improving profitability supports İş Yatırım’s dividend expectation: Net income was up about 65% in the first half of this year.

|

SBI UPDATES DID YOU KNOW the SBI platform is online? It contains a competitive dashboard of shopping malls, grocery retail, as well as the latest macro indicators and research reports. A few highlights: EARNINGS DOWNGRADE AHEAD FOR CARREFOUR SA- Morgan Stanley estimates Carrefour SA basis recent trends, first-half results, foreign exchange, and completed M&A. This results in an average reduction of 6% to recurring EBIT for 2024-2026, placing operating profit 4% below consensus and EPS 4% below consensus. For 2024, the impact is larger, with estimates 9% below consensus, and downgrades expected across all divisions. Given this earnings outlook, along with additional uncertainty related to French taxes (which could pose a 7% headwind for 2024 based on sensitivity analysis), Carrefour's shares are likely to face near-term pressure. UAE QUARTERLY ECONOMIC REVIEW- The UAE’s efforts to diversify its economy and strengthen ties with key trading partners have resulted in a record AED 669.9 bn in non-oil foreign trade in 1Q 2024, equivalent to 141% of GDP, according to the Central Bank of the UAE. This growth, driven by comprehensive economic partnership agreements, is expected to continue through 2024 and 2025, supporting real GDP growth projections of 4% in 2024 and 6% in 2025. OPEC+ decisions on production quotas amid global uncertainties will influence overall growth, but the non-hydrocarbon sector remains strong, with forecasted growth of 5.2% in 2024 and 5.3% in 2025. In the Abu Dhabi real estate sector, sales transactions in January-June 2024 rose by 2.3% year-on-year, with the apartment sales price index increasing by 6.2% and the villa sales price index by 3.9% in Q2 2024. Dubai saw even greater activity, with residential sales transactions up by 34.8% year-on-year in the first half of 2024. Apartment and villa sales prices increased by 14.3% and 25.3%, respectively. The transportation and tourism sectors also performed strongly, with tourist arrivals up by 14.2%. Passenger traffic at Abu Dhabi and Dubai airports surged by 33.8% and 8% year-on-year. Inflation forecasts for 2024 have been revised from 2.3% to 2.2%, with 2025 inflation also projected at 2.2%. |

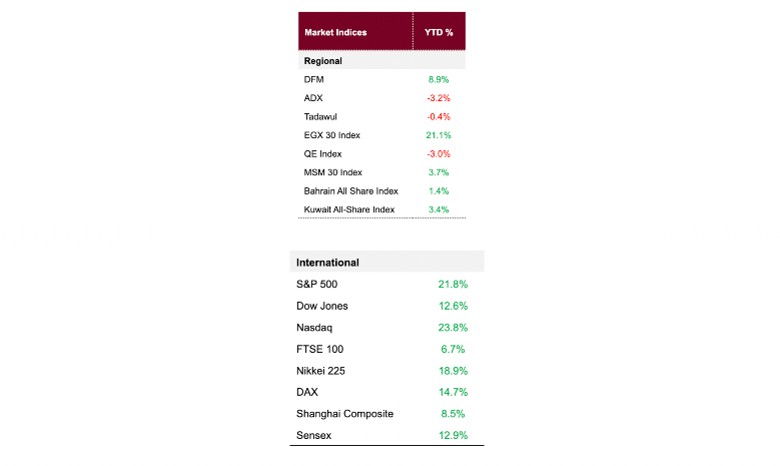

MARKET INDICES

(Data is as of last Friday’s close) |

|

|